INVESTMENT STRATEGY

Aminim actively pursues commercial real estate opportunities in the United States, with a focus on multifamily, residential, industrial and logistics properties. Our multifamily acquisition targets in the United States are typically Class A or Class B assets, garden-style or mid-rise construction, consisting of 100-400 units. When purchasing industrial and logistics assets either in the U.S., our targets are typically facilities that are strategically situated within their markets, house A-grade tenants, and have favorable lease lengths and terms.

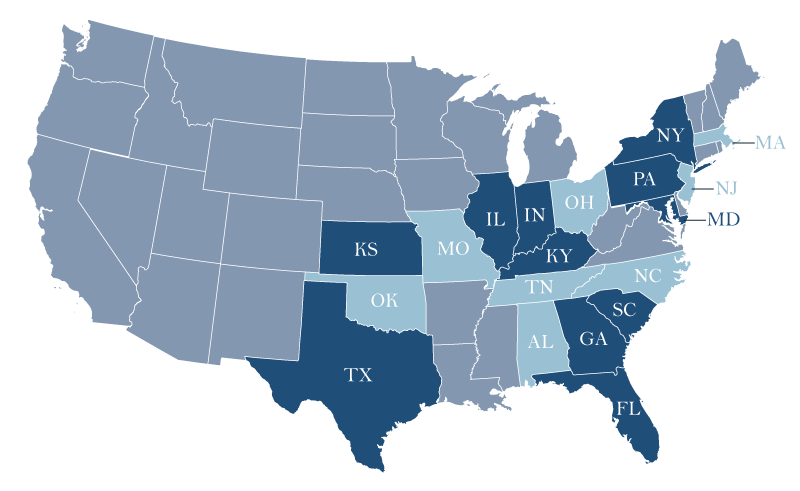

Aminim’s preferred locations are markets with high historical and projected population and job growth, and have proven sound economic fundamentals. Markets with positive migration from the renting demographic (Millennials, Baby-Boomers, Gen-Z) are top priority for multifamily and residential acquisitions, as are supply-constrained markets or locations where absorption of new supply is rapid. Aminim targets industrial and logistics real estate in markets where there is a high availability of qualified labor, convenient access to major thoroughfares and transportation, and substantive regional economic growth.

- CURRENT HOLDINGS

- ADDITIONAL TARGET MARKETS

Aminim adopts a conservative investment philosophy, and pursues deals which forecast a combination of annual yields and appreciation upon exit, to produce an attractive IRR.

Our goal is to maintain a balanced risk-return profile with upside potential and downside protection. To achieve this, Aminim looks to invest in properties which already exhibit good fundamentals and also offer tangible value-add opportunities, such as upgrades to unit interiors, enhancements to community amenities, or improving the day-to-day management of the property. These projects ultimately allow for the application of rent premiums, boosting the property’s bottom line and adding value to the investment.

In general, Aminim underwrites for an ownership period of between 3-7 years. Aminim looks to capitalize each investment with roughly 30%-40% equity, the remainder with agency-financed loans or loans from Tier I rated banks. Deals with the potential for an accretive refinance after 2-3 years of management are also favorable, although this will rarely impact the acquisition decision.